FAQ: What Happens After I Report a Car Accident?

Understanding the Initial Steps After Reporting a Car Accident Claim

Okay, so you've just reported a car accident to your insurance company. Take a deep breath! It can feel overwhelming, but knowing what to expect can make the whole process a lot smoother. This is where we break down the immediate aftermath of that initial report. Think of it as your post-accident roadmap.

First things first, expect a call (or email) from your insurance adjuster. This person is your point of contact, your guide through the claim process. They'll want to gather more details about the accident. Be prepared to answer questions about:

- The date, time, and location of the accident.

- A detailed description of what happened, in your own words.

- Information about the other driver(s) involved, including their name, insurance information, and contact details.

- Any police report numbers or contact information for the responding officers.

- Photos or videos you might have taken at the scene.

Honesty is key here. Be truthful and accurate in your account of the accident. Don't speculate or guess about anything you're unsure of. If you don't remember something clearly, say so. Also, keep a record of all communication with your adjuster – dates, times, topics discussed, and any agreements made. This will be invaluable if any disputes arise later on.

The adjuster will likely also want to see the damage to your vehicle. They might ask you to take it to a specific repair shop for an estimate, or they might send an appraiser to your location. We'll delve into the repair process more later, but just know that this is a crucial step in determining the extent of the damage and the cost of repairs.

Gathering Evidence and Documentation for Your Car Accident Claim

Now, let's talk about building a solid case. Think of yourself as a detective, gathering all the clues to support your claim. The more evidence you have, the stronger your position will be. Here's a breakdown of what you should be collecting:

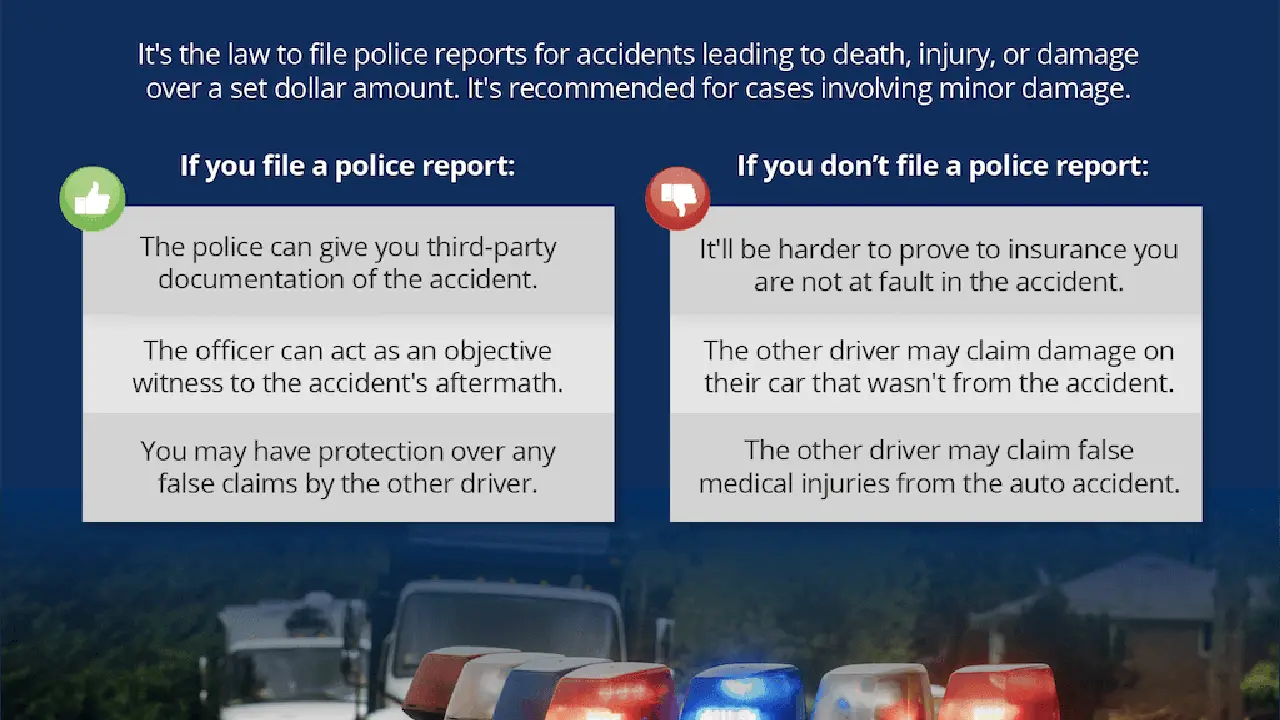

- Police Report: This is a crucial document. It contains the officer's assessment of the accident, including who they believe was at fault. Obtain a copy as soon as possible.

- Photos and Videos: If you took any photos or videos at the scene, these are gold. They can provide visual evidence of the damage to the vehicles, the road conditions, and the surrounding area.

- Witness Statements: If there were any witnesses to the accident, get their contact information and ask if they're willing to provide a statement. A neutral third-party account can be very helpful.

- Medical Records: If you or any passengers were injured in the accident, keep detailed records of all medical treatment, including doctor's visits, hospital stays, physical therapy, and medication.

- Lost Wage Documentation: If you've had to miss work due to your injuries, gather documentation to prove your lost wages, such as pay stubs, employer letters, or tax returns.

- Other Expenses: Keep track of any other expenses you've incurred as a result of the accident, such as rental car costs, towing fees, or property damage.

Organize all of this documentation carefully. Create a file (physical or digital) and keep everything in one place. This will make it much easier to access and share the information with your adjuster.

Understanding Your Car Insurance Policy and Coverage Options

Your car insurance policy is the rulebook for your claim. It outlines what's covered, what's not, and the limits of your coverage. Understanding your policy is essential for navigating the claim process effectively. Let's break down some common coverage types:

- Liability Coverage: This covers damages you cause to others in an accident where you're at fault. It includes bodily injury liability (for injuries to other people) and property damage liability (for damage to their vehicles or property).

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who was at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This covers your injuries and damages if you're hit by an uninsured driver or a driver who doesn't have enough insurance to cover your losses.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages, regardless of who was at fault in the accident. (Note: PIP is not available in all states.)

Pay close attention to your policy limits. These are the maximum amounts your insurance company will pay for each type of coverage. If your damages exceed your policy limits, you may be responsible for paying the difference out of pocket. If you're unsure about your coverage, don't hesitate to ask your insurance agent or adjuster for clarification.

Navigating the Car Repair Process and Getting Estimates

So, your car is damaged. Now what? Getting your car repaired is a critical part of the claim process. Here's what you need to know about getting estimates and working with repair shops:

Your insurance company may recommend certain repair shops. These are often called "direct repair program" (DRP) shops. These shops have agreements with the insurance company to provide repairs at a predetermined rate. While you're not obligated to use a DRP shop, it can sometimes streamline the process.

It's always a good idea to get multiple estimates from different repair shops. This will give you a better sense of the fair market value for the repairs. When getting estimates, be sure to:

- Ask for a detailed breakdown of the repairs needed.

- Inquire about the type of parts being used (e.g., OEM, aftermarket, recycled).

- Check the shop's reputation and read online reviews.

- Ask about the shop's warranty on their repairs.

Once you've chosen a repair shop, work with them and your insurance adjuster to get the repairs authorized. The adjuster may need to inspect the vehicle before authorizing the repairs. Once the repairs are complete, be sure to inspect the work carefully to ensure it meets your satisfaction.

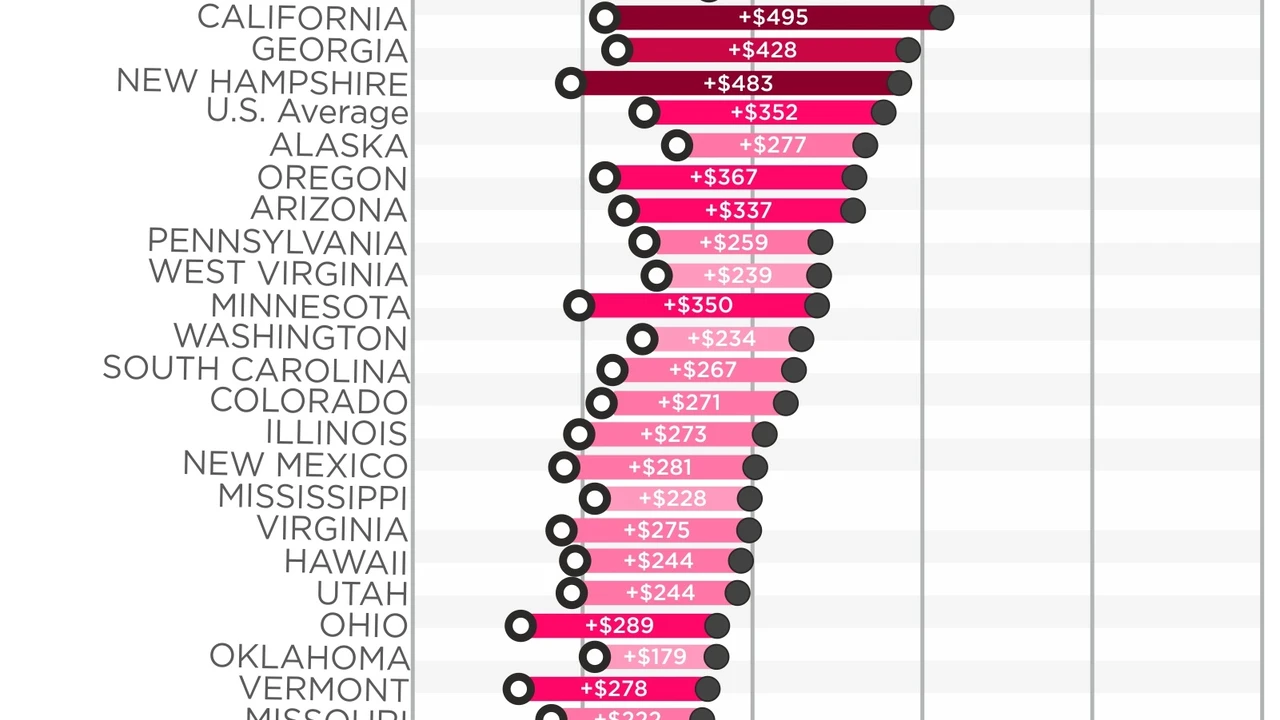

Understanding Diminished Value and How to Claim It After a Car Accident

Even after your car is repaired, it may still be worth less than it was before the accident. This is known as "diminished value." Diminished value is the difference between the car's market value before the accident and its market value after the repairs. You may be able to claim diminished value from the at-fault driver's insurance company.

There are several types of diminished value:

- Inherent Diminished Value: This is the loss of value due to the fact that the car has been in an accident, regardless of the quality of the repairs.

- Repair-Related Diminished Value: This is the loss of value due to substandard repairs.

- Claim-Related Diminished Value: This is the loss of value due to the stigma associated with having a claim history.

To claim diminished value, you'll need to provide evidence of the loss of value. This may include:

- A professional appraisal from a qualified appraiser.

- Documentation of the accident and repairs.

- Evidence of comparable vehicles that have not been in accidents.

Diminished value claims can be complex, so it's often helpful to consult with an attorney.

Negotiating a Settlement and Resolving Disputes with the Car Insurance Company

Once you've completed all the necessary steps, you'll likely enter into negotiations with the insurance company to reach a settlement. The insurance company will typically make an initial offer, which you can accept, reject, or counteroffer. Negotiation is a key part of the process, and it's important to be prepared to advocate for your rights.

Here are some tips for negotiating a settlement:

- Know the value of your claim. Be realistic about the damages you've suffered and the compensation you deserve.

- Be prepared to back up your claims with evidence.

- Be polite but firm. Don't be afraid to stand your ground.

- Document all communication with the insurance company.

- Consider consulting with an attorney if you're having trouble reaching a settlement.

If you're unable to reach a settlement with the insurance company, you may have to resort to other options, such as mediation or litigation.

Understanding the Role of a Car Accident Lawyer and When to Hire One

Navigating the complexities of a car accident claim can be daunting. Sometimes, it's beneficial to seek the assistance of a car accident lawyer. A lawyer can provide valuable guidance, protect your rights, and help you obtain the compensation you deserve. Here are some situations where hiring a lawyer might be a good idea:

- You've suffered serious injuries.

- The insurance company is denying your claim or offering a low settlement.

- The accident involved a commercial vehicle or a government entity.

- There are disputes about who was at fault.

- You're unsure about your rights or the legal process.

A lawyer can help you:

- Investigate the accident and gather evidence.

- Negotiate with the insurance company.

- File a lawsuit if necessary.

- Represent you in court.

When choosing a lawyer, look for someone with experience in car accident cases, a strong track record, and a commitment to protecting your interests.

Recommended Products: Dash Cams and Car Accident Emergency Kits

Let's talk about some products that can be incredibly helpful in the event of a car accident. These aren't insurance products, but rather tools that can assist in documenting the accident and ensuring your safety.

Dash Cams: Your Silent Witness

A dash cam is a small camera that mounts on your dashboard and records video of the road ahead. In the event of an accident, the dash cam footage can provide crucial evidence to help determine fault. Here are a few recommended dash cams:

- Vantrue N4 Pro: A high-end dash cam with three-channel recording (front, interior, and rear), 4K resolution, and excellent night vision. Ideal for rideshare drivers or anyone who wants comprehensive coverage. Price: Around $300.

- Garmin Dash Cam 67W: A reliable and user-friendly dash cam with a wide 180-degree field of view and automatic incident detection. A good option for everyday drivers. Price: Around $200.

- Rexing V1P Pro: A budget-friendly dash cam with dual-channel recording (front and rear), 1080p resolution, and loop recording. A great option for those on a tight budget. Price: Around $100.

Comparison: The Vantrue N4 Pro offers the best image quality and features, but it's also the most expensive. The Garmin Dash Cam 67W is a good balance of price and performance. The Rexing V1P Pro is a solid choice for those looking for an affordable option.

Usage Scenario: Imagine you're involved in a fender bender. The other driver claims you ran a red light. With a dash cam, you have video evidence to prove that you had the green light, protecting you from liability.

Car Accident Emergency Kits: Be Prepared for Anything

A car accident emergency kit contains essential supplies to help you deal with the immediate aftermath of an accident. Here are some recommended kits and their contents:

- AAA Roadside Assistance Kit: A comprehensive kit that includes jumper cables, a flashlight, a first-aid kit, a warning triangle, and other essential items. Price: Around $50.

- Lifeline First Aid 85 Piece All-Purpose First Aid Kit: A well-stocked first-aid kit with bandages, antiseptic wipes, pain relievers, and other medical supplies. Price: Around $20.

- Resqme The Original Keychain Car Escape Tool: A small but powerful tool that can cut seatbelts and break car windows in an emergency. Price: Around $15.

Comparison: The AAA Roadside Assistance Kit is a good all-in-one option. The Lifeline First Aid Kit is a must-have for any car. The Resqme tool can be a lifesaver in a serious accident.

Usage Scenario: You're involved in an accident and your car is disabled on the side of the road. Your emergency kit provides you with a warning triangle to alert other drivers, a flashlight to see in the dark, and a first-aid kit to treat minor injuries.

Final Thoughts

Dealing with a car accident is never fun, but hopefully, this guide has given you a better understanding of what to expect after you report an accident. Remember to stay calm, gather evidence, understand your insurance policy, and don't hesitate to seek professional help if you need it. Drive safe!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)