FAQ: What is Subrogation and How Does It Affect My Claim?

Understanding Subrogation Car Insurance Claims Explained

Alright, let's dive into the murky waters of subrogation. Sounds complicated, right? It's actually pretty straightforward. Think of it as your insurance company stepping into your shoes to recover money from the at-fault party after they've paid you for damages. Basically, if someone else caused the accident and your insurance company pays for your repairs or medical bills, they have the right to try and get that money back from the other driver's insurance company or even the driver themselves.

Why does this matter to you? Well, it can affect your deductible, your premiums, and even your legal options. Let's break it down.

How Subrogation Works in Car Accidents A Step By Step Guide

Okay, imagine this scenario: you're cruising down the street, minding your own business, when BAM! Some knucklehead runs a red light and slams into your car. Your insurance company pays for the damages to your vehicle. That's where subrogation comes in.

- Your Insurance Pays: Your insurance company covers your losses according to your policy.

- Investigation: They investigate the accident to determine who was at fault. Police reports, witness statements, and even photos of the scene play a big role here.

- Subrogation Process: If you weren't at fault, your insurance company will attempt to recover the money they paid you from the at-fault driver's insurance company. They'll send demand letters, negotiate settlements, and even file lawsuits if necessary.

- Deductible Reimbursement: If they're successful in recovering the money, you might get your deductible back! This is a big win.

- Impact on Your Premiums: If you weren't at fault and your insurance company recovers the money, it shouldn't affect your premiums. However, if you were partially at fault, it could still have an impact.

Subrogation and Your Deductible Getting Your Money Back

Let's talk deductibles. Nobody likes paying them, right? Subrogation gives you a chance to get that money back. If your insurance company successfully recovers the money from the at-fault party, they're usually required to reimburse you for your deductible. It's like a little reward for going through the whole ordeal.

Keep in mind that the process can take time. Insurance companies aren't exactly known for their speed. Be patient and stay in contact with your insurance adjuster. They'll keep you updated on the progress of the subrogation process.

The Impact of Subrogation on Your Car Insurance Rates Understanding the Risks

Here's the thing: being involved in an accident, even if it's not your fault, can sometimes affect your insurance rates. However, if your insurance company successfully subrogates and recovers the money, it shouldn't impact your rates as much as if they weren't able to recover anything. The key is to prove that you weren't at fault. That's why it's so important to gather as much evidence as possible at the scene of the accident, including photos, witness information, and police reports.

If you're concerned about your rates going up, talk to your insurance agent. They can explain how subrogation might affect your specific situation.

Subrogation and Total Loss Claims Navigating Complex Scenarios

What happens if your car is totaled? The subrogation process is similar, but there are a few extra steps involved. Your insurance company will pay you the fair market value of your vehicle, and then they'll try to recover that amount from the at-fault party's insurance company.

One thing to keep in mind is that you'll need to transfer ownership of your totaled vehicle to your insurance company. They'll then sell it for salvage, and that money will go towards offsetting the amount they paid you. It's all part of the process.

When to Get a Lawyer for Subrogation Complex Cases Explained

Sometimes, subrogation can get complicated. If the at-fault driver is uninsured or underinsured, or if there's a dispute about who was at fault, you might need to get a lawyer involved. A lawyer can help you navigate the legal process, negotiate with the insurance companies, and even file a lawsuit if necessary.

Here are some situations where you might want to consider hiring a lawyer:

- Serious Injuries: If you suffered serious injuries in the accident, a lawyer can help you recover compensation for your medical bills, lost wages, and pain and suffering.

- Uninsured Driver: If the at-fault driver is uninsured, a lawyer can help you pursue a claim against your own uninsured motorist coverage.

- Disputed Liability: If there's a dispute about who was at fault, a lawyer can help you gather evidence and build a strong case.

- Significant Damages: If your car was totaled or you suffered significant property damage, a lawyer can help you recover the full value of your losses.

Subrogation vs Waiver of Subrogation What's the Difference

Now, let's throw a wrench in things: waiver of subrogation. This is where you give up your right to subrogate. This usually happens in business contracts, especially in construction or lease agreements. For example, if you're renting an apartment and a pipe bursts, flooding your belongings, your renter's insurance might pay for the damages. However, your insurance company might have the right to sue the landlord for negligence. A waiver of subrogation would prevent them from doing so.

It's crucial to understand these clauses in contracts because they can significantly impact your rights and responsibilities.

Subrogation and Rental Car Accidents A Guide for Renters

Renting a car adds another layer of complexity. If you're in an accident while driving a rental car, the subrogation process can involve multiple insurance companies – your own, the rental car company's, and the at-fault driver's. It's important to understand the terms of your rental agreement and your own insurance policy to know who's responsible for what.

Consider purchasing supplemental insurance from the rental car company to provide additional coverage in case of an accident.

Subrogation and Motorcycle Accidents Unique Considerations

Motorcycle accidents often involve serious injuries, which can complicate the subrogation process. Insurance companies may be more reluctant to pay out large settlements in motorcycle cases, so it's even more important to have a lawyer on your side to protect your rights.

Also, be aware of the laws regarding motorcycle insurance in your state. Some states require motorcycle riders to carry personal injury protection (PIP) coverage, which can help pay for medical bills regardless of who was at fault.

Subrogation and Pedestrian Accidents Protecting Your Rights

If you're hit by a car while walking, you have the right to pursue a claim against the driver's insurance company. The subrogation process is similar to car accident cases, but it's even more important to gather evidence to prove that the driver was at fault.

Be sure to get the driver's insurance information and contact the police immediately. Also, take photos of the scene and gather contact information from any witnesses.

Subrogation and Bicycle Accidents Navigating the Legal Landscape

Similar to pedestrian accidents, bicycle accidents can lead to complex subrogation claims. Document everything, get witness statements, and consult with an attorney specializing in bicycle accidents. Many drivers are not attentive to cyclists, leading to accidents where the cyclist is clearly not at fault. Ensure you have proper representation to deal with insurance companies.

Real-Life Subrogation Examples Learning from Case Studies

Let's look at some real-life examples to illustrate how subrogation works:

- Example 1: You're rear-ended at a stoplight. Your insurance pays for the repairs to your car. They then pursue a claim against the other driver's insurance company and successfully recover the money. You get your deductible back, and your rates don't go up.

- Example 2: You're involved in a multi-car pileup. Determining who was at fault is complicated. Your insurance company investigates the accident and determines that another driver was primarily responsible. They pursue a subrogation claim, but the other driver's insurance company denies the claim. You end up having to pay your deductible and your rates go up slightly.

- Example 3: You're hit by an uninsured driver. Your insurance company pays for your medical bills and car repairs under your uninsured motorist coverage. They then try to recover the money from the uninsured driver, but they're unable to do so. Your rates might go up slightly as a result.

Subrogation and the Role of Your Insurance Adjuster Understanding Their Perspective

Your insurance adjuster plays a key role in the subrogation process. They're responsible for investigating the accident, determining who was at fault, and pursuing a claim against the at-fault party's insurance company. It's important to communicate with your adjuster and provide them with all the information they need to build a strong case.

Be polite and professional, but also be assertive in protecting your rights. Don't be afraid to ask questions and challenge their decisions if you disagree with them.

Subrogation and the Importance of Documentation Keeping Records

Documentation is key to a successful subrogation claim. Keep detailed records of everything related to the accident, including:

- Police Report: A copy of the police report is essential.

- Photos of the Scene: Take photos of the damage to your vehicle, the other vehicle, and the surrounding area.

- Witness Information: Get the names and contact information of any witnesses.

- Medical Records: Keep copies of your medical bills and records.

- Repair Estimates: Get estimates for the repairs to your vehicle.

- Correspondence with Insurance Companies: Keep copies of all letters, emails, and phone calls with your insurance company and the at-fault party's insurance company.

Subrogation and Alternative Dispute Resolution Mediation and Arbitration

Sometimes, insurance companies can't agree on who was at fault or how much money should be paid. In these cases, they may turn to alternative dispute resolution (ADR) methods like mediation or arbitration. Mediation involves a neutral third party who helps the parties reach a settlement agreement. Arbitration involves a neutral third party who makes a binding decision on the dispute.

ADR can be a faster and less expensive way to resolve disputes than going to court.

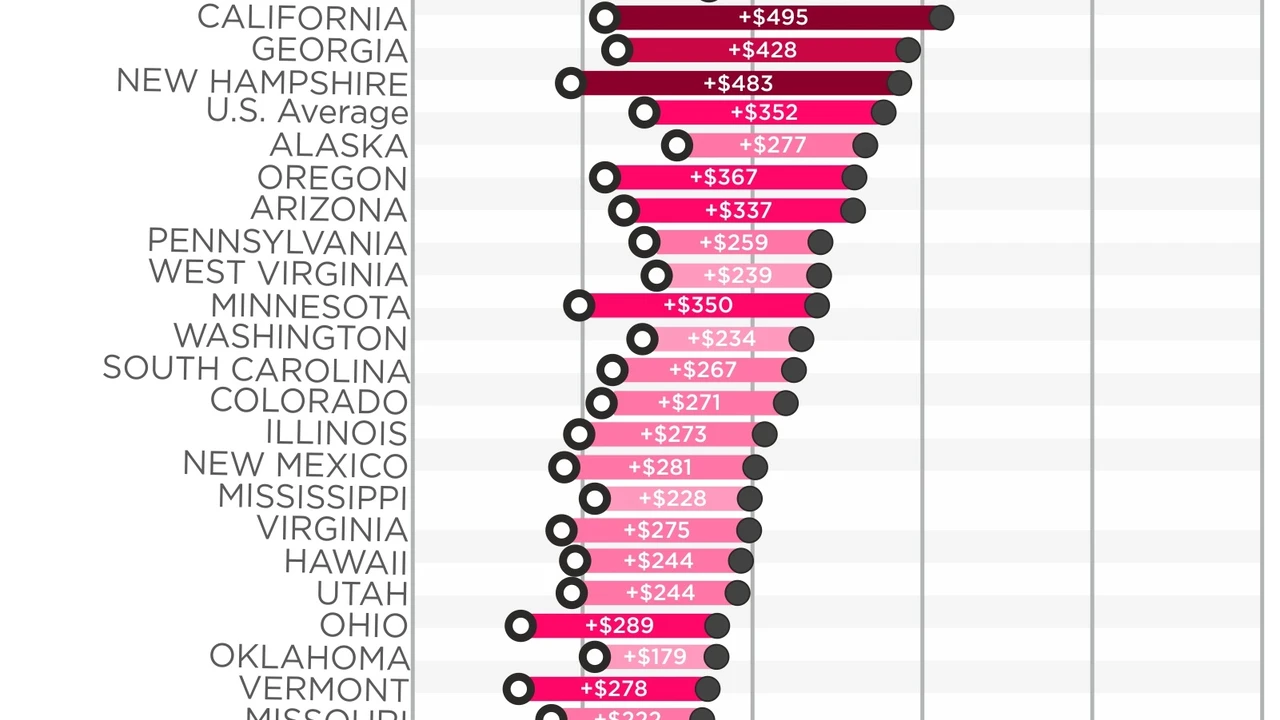

Subrogation and State Laws Variations Across the US

Subrogation laws vary from state to state. Some states have laws that protect consumers from unfair subrogation practices, while others don't. It's important to understand the laws in your state to know your rights.

Check with your state's insurance department or consult with a lawyer to learn more about subrogation laws in your area.

Subrogation and Future of Car Insurance Technological Advancements

With the rise of autonomous vehicles and advanced driver-assistance systems (ADAS), the future of subrogation is likely to change. It may become easier to determine who was at fault in an accident, thanks to data from sensors and cameras. However, it could also lead to new legal challenges, such as determining liability when a self-driving car malfunctions.

Recommended Products for Protecting Yourself After an Accident

Okay, so you've been in an accident. Here are a few things that can help protect you and your claim. Remember, I can't give financial advice, so consider this general information.

- Dash Cam: The Vantrue N4 (around $250) is a popular choice. It records front, rear, and inside the car, providing crucial evidence in case of an accident. Imagine the peace of mind knowing you have video proof of what happened! It's great for Uber/Lyft drivers too. A cheaper option is the Rexing V1 (around $100), which offers excellent front recording capabilities. Compare them: the N4 has more features, but the V1 is more budget-friendly and easier to use.

- Accident Recorder App: Apps like Automatic (requires an adapter, around $100) or Bouncie (subscription required) automatically record accident data, including speed, impact force, and location. They can even notify emergency services. Think of it as a black box for your car.

- First Aid Kit: A well-stocked first aid kit is essential for any car. The First Aid Only 299 Piece All-Purpose First Aid Kit (around $20) is a good option. It’s compact and has everything you need for minor injuries. Consider supplementing it with a tourniquet if you're trained in its use.

- Personal Injury Protection (PIP) Insurance: Even if it's not required in your state, consider adding PIP coverage to your policy. It can help pay for your medical bills, regardless of who was at fault. Prices vary depending on your state and coverage level.

Understanding Uninsured and Underinsured Motorist Coverage

This coverage is crucial! If you're hit by someone without insurance or with insufficient coverage, this will protect *you*. Don't skimp on this. Talk to your insurance agent about appropriate levels based on your financial situation.

Negotiating with Insurance Companies Tips and Strategies

Insurance companies are businesses. They want to pay out as little as possible. Be prepared to negotiate. Document everything. Don't be afraid to push back if you feel you're being offered a low settlement. Having a lawyer can be *extremely* helpful in these situations.

The Importance of Reporting an Accident to the Police

Always report an accident to the police, even if it seems minor. A police report provides an official record of the accident and can be crucial in determining fault. It's also required by law in many states.

Dealing with Pain and Suffering After a Car Accident

Don't underestimate the emotional impact of a car accident. Pain and suffering are real. Seek medical attention for both physical and emotional injuries. Keep a journal to document your pain levels and emotional distress. This can be helpful in your claim.

Final Thoughts on Navigating the Subrogation Process

Subrogation can seem daunting, but understanding the process empowers you to protect your rights. Stay informed, document everything, and don't hesitate to seek professional help when needed.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)