FAQ: Will My Car Insurance Rates Increase After a Claim?

Understanding Car Insurance Rate Increases After an Accident Claim

Okay, so you've been in an accident, filed a claim, and now you're sweating bullets about your car insurance rates. Totally understandable! It's a common worry. Let's break down what typically happens and what factors come into play. It's not always a straightforward "yes" or "no" answer, unfortunately. Think of it more like a "maybe, depending on..." kind of situation. We'll cover everything from fault to claim history to even the state you live in.

Fault vs No-Fault: Who's to Blame?

First things first: whose fault was the accident? If you were clearly at fault – meaning you caused the accident – then yeah, there's a pretty good chance your rates will go up. Insurance companies see at-fault accidents as a sign that you're a higher risk to insure. They figure you're more likely to cause another accident in the future. Think of it like this: they’re betting on whether you’ll cost them money again. If you’re the reason for the first payout, the odds aren’t in your favor.

On the other hand, if you weren't at fault – say, you were rear-ended at a stoplight – then your rates might not increase. In many states, insurance companies aren't allowed to raise your rates for accidents that weren't your fault. However, even in no-fault situations, there are exceptions. For example, if you have a history of accidents, even not-at-fault ones, your rates could still be affected. It's all about that risk assessment again.

The Severity of the Claim: How Much Did It Cost?

Another factor is the size of the claim. A small fender bender that costs a few hundred dollars to fix might not impact your rates as much as a major accident that results in thousands of dollars in damages or injuries. Insurance companies often have a threshold. If the claim amount is below a certain number, they might not raise your rates. It's like they're willing to overlook a minor incident, but a big payout is a red flag.

Think about it from their perspective. They're in the business of managing risk. A small claim is a manageable risk, while a large claim represents a significant financial burden. The larger the burden, the more likely they are to adjust your rates to compensate.

Your Insurance Claim History: A Pattern of Accidents?

Your past driving record and claim history play a significant role. If you have a clean driving record with no prior accidents or tickets, you're less likely to see a rate increase after a single claim. However, if you have a history of accidents, even if some of them weren't your fault, your insurance company might view you as a high-risk driver and raise your rates accordingly. They're looking for patterns. A single accident might be an anomaly, but a string of accidents suggests a consistent problem.

It's also worth noting that some insurance companies offer accident forgiveness programs. If you have this coverage, your rates won't increase after your first at-fault accident. However, these programs often come with specific eligibility requirements and may not be available in all states. So, check your policy details!

State Regulations: Where You Live Matters

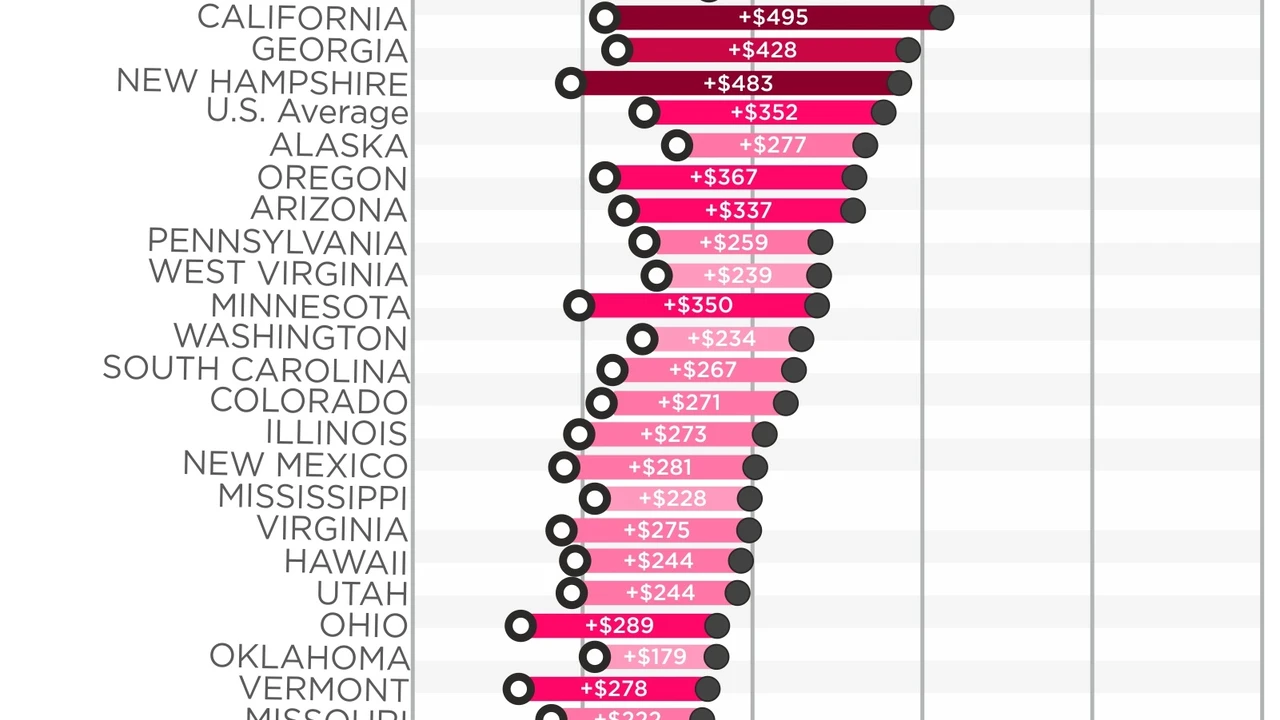

Insurance regulations vary from state to state. Some states have stricter rules about when insurance companies can raise rates after an accident. Other states are more lenient. It's essential to understand the insurance laws in your state to know your rights and what to expect. You can usually find this information on your state's Department of Insurance website. Just Google "[Your State] Department of Insurance."

For example, some states prohibit insurance companies from raising rates for not-at-fault accidents, while others allow it under certain circumstances. Knowing the rules of the game in your state is crucial.

Specific Scenarios and Rate Increase Impacts

Minor Fender Bender: Will It Affect My Premium?

Let's say you backed into a parked car and caused minor damage. The repair costs are relatively low, maybe a few hundred dollars. In this scenario, your rates might not increase significantly, especially if you have a good driving record. However, it's always a good idea to check with your insurance company to understand their specific policies.

You might also consider paying for the repairs out of pocket to avoid filing a claim altogether. This could be a good option if the repair costs are less than your deductible and you want to avoid any potential rate increases. It's a gamble, but sometimes it pays off.

Major Accident with Injuries: Expect a Premium Hike

If you were involved in a major accident that resulted in serious injuries or significant property damage, you should expect your rates to increase. These types of claims are expensive for insurance companies, and they'll likely adjust your rates to reflect the increased risk.

In this case, it's even more critical to shop around for different insurance quotes. Your current insurance company might significantly raise your rates, but other companies might offer more competitive pricing. Don't be afraid to switch providers!

Hit-and-Run: What Happens to My Insurance?

If you're the victim of a hit-and-run accident, your insurance coverage will depend on your policy and the laws in your state. Typically, if the other driver is uninsured or unidentified, your uninsured motorist coverage will kick in to cover your damages. Whether your rates will increase depends on your state's laws and your insurance company's policies. In many cases, your rates won't increase because you weren't at fault.

However, it's essential to report the accident to the police and your insurance company as soon as possible. This will help ensure that your claim is processed correctly and that you receive the coverage you're entitled to.

Strategies to Mitigate Rate Increases

Shop Around for Car Insurance: Compare Quotes

The best way to potentially mitigate a rate increase after a claim is to shop around for car insurance. Don't just stick with your current provider. Get quotes from multiple companies to see who offers the best rates. Insurance rates can vary significantly between companies, so it pays to compare.

Websites like NerdWallet, The Zebra, and Policygenius are great resources for comparing car insurance quotes. They allow you to enter your information once and receive quotes from multiple insurance companies. It's a quick and easy way to see if you can find a better deal.

Increase Your Deductible: A Risky But Potentially Rewarding Move

Consider increasing your deductible. A higher deductible means you'll pay more out of pocket if you have an accident, but it also means your monthly premiums will be lower. If you're a safe driver and confident in your ability to avoid accidents, increasing your deductible could save you money in the long run.

However, make sure you can afford to pay the higher deductible if you do have an accident. You don't want to be caught in a situation where you can't afford to repair your car because you chose too high of a deductible.

Improve Your Driving Habits: Avoid Future Claims

This one's obvious, but it's worth repeating: improve your driving habits. Avoid speeding, distracted driving, and other risky behaviors. The fewer accidents you have, the lower your insurance rates will be. Take a defensive driving course. Many insurance companies offer discounts for completing these courses.

Think of it as an investment in your future. By improving your driving habits, you're not only reducing your risk of accidents, but you're also saving money on your car insurance.

Recommended Products and Their Usage Scenarios

Progressive Snapshot: Usage-Based Insurance

Progressive Snapshot is a usage-based insurance program that tracks your driving habits using a mobile app or a plug-in device. It monitors things like hard braking, speeding, and nighttime driving. If you're a safe driver, you can earn significant discounts on your car insurance rates. It's perfect for people who drive safely and want to be rewarded for it. However, if you have a tendency to speed or brake hard, this might not be the best option for you.

Usage Scenario: Ideal for drivers who commute during off-peak hours, avoid speeding, and generally practice safe driving habits. Great for families with teenagers who want to monitor their driving behavior.

Comparison: Compared to traditional insurance, Snapshot offers potential discounts based on your actual driving behavior. Other similar programs include State Farm Drive Safe & Save and Allstate Drivewise.

Pricing: The discount you can receive varies based on your driving habits. Some users have reported saving up to 30% on their premiums.

Automatic Pro: Connected Car Adapter

While not directly insurance-related, Automatic Pro is a connected car adapter that can help you improve your driving habits and potentially save money on gas. It tracks your driving behavior, provides real-time feedback, and can even diagnose car problems. By using Automatic Pro, you can become a safer and more efficient driver, which could lead to lower insurance rates in the long run.

Usage Scenario: Perfect for drivers who want to track their mileage, monitor their driving habits, and diagnose car problems before they become major issues. Useful for businesses that manage a fleet of vehicles.

Comparison: Compared to other connected car adapters, Automatic Pro offers a comprehensive set of features, including accident detection and emergency assistance.

Pricing: The Automatic Pro adapter typically costs around $100.

Dash Cams: Evidence in Case of an Accident

A dash cam can provide valuable evidence in case of an accident. It records video footage of your driving, which can be used to prove your innocence or determine fault. This can be especially helpful in situations where the other driver is lying or there are no witnesses. Having video evidence can make the claims process much smoother and potentially prevent your rates from increasing unnecessarily. Consider the Vantrue N4 or the Garmin Dash Cam 67W.

Usage Scenario: Essential for drivers who want to protect themselves from fraudulent claims or have proof of what happened in an accident. Particularly useful for rideshare drivers and delivery drivers.

Comparison: Dash cams vary in terms of features, video quality, and storage capacity. Look for a dash cam with loop recording, wide-angle lens, and night vision capabilities.

Pricing: Dash cams range in price from around $50 to $300, depending on the features and quality.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)