Step 1: Reporting the Accident to Your Insurance

Understanding Your Insurance Policy After an Accident

Okay, so you've been in an accident. Not fun, right? The first thing you need to do, even before you start thinking about repairs or medical bills, is to report the accident to your insurance company. But before you pick up the phone, let's make sure you understand your policy. Dig out those documents (or log in to your online account) and familiarize yourself with your coverage. What's your deductible? What are your liability limits? Knowing this stuff upfront will save you a lot of headaches later.

Think of your insurance policy as a roadmap. It outlines exactly what's covered, how much they'll pay, and what your responsibilities are. Ignoring it is like driving without a GPS – you might get where you're going, but it'll be a lot harder and you'll probably take a few wrong turns.

Gathering Essential Information for Your Insurance Claim

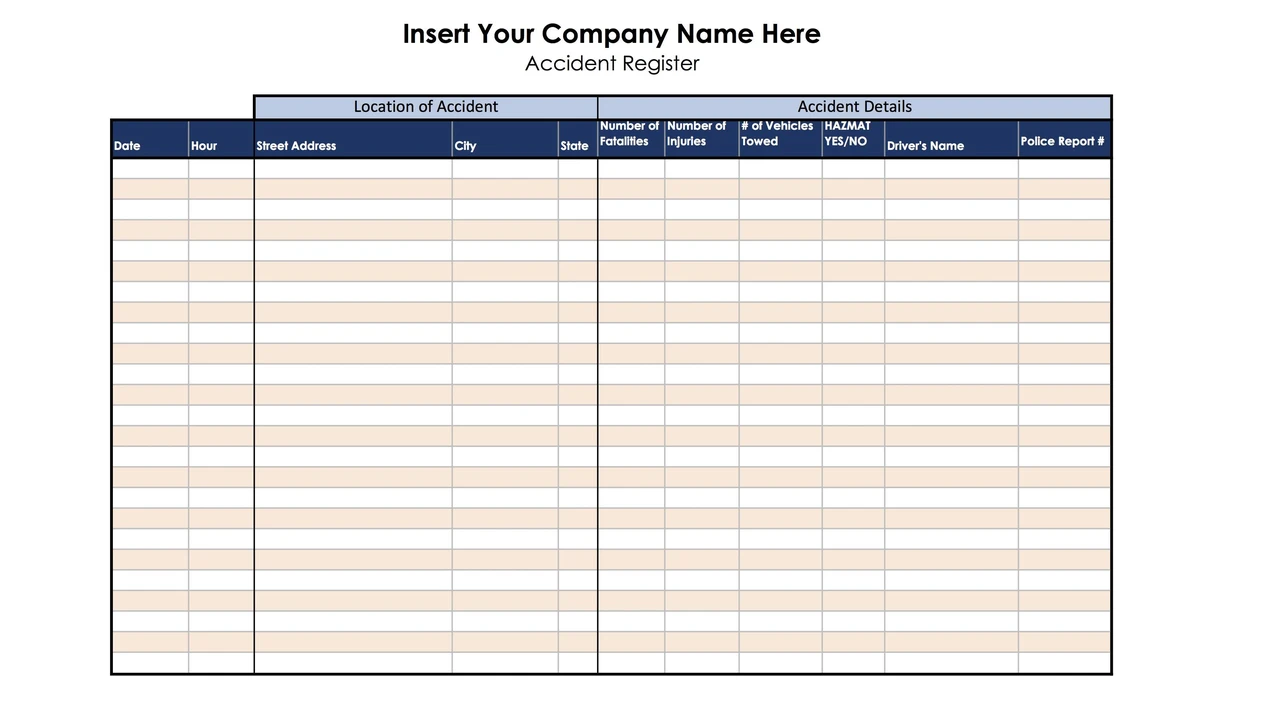

Before you call your insurance company, get your ducks in a row. This means collecting all the relevant information about the accident. Write down everything you remember, no matter how small it seems. Details are your friend here. You'll need:

- Your Policy Number: Obvious, but crucial.

- Date, Time, and Location of the Accident: Be as precise as possible.

- Description of the Accident: What happened? Who was involved? What were the weather conditions?

- Other Driver's Information: Name, address, phone number, insurance company, and policy number. Get a photo of their insurance card if you can.

- Vehicle Information: Make, model, and license plate number of all vehicles involved.

- Witness Information: Names, addresses, and phone numbers of any witnesses.

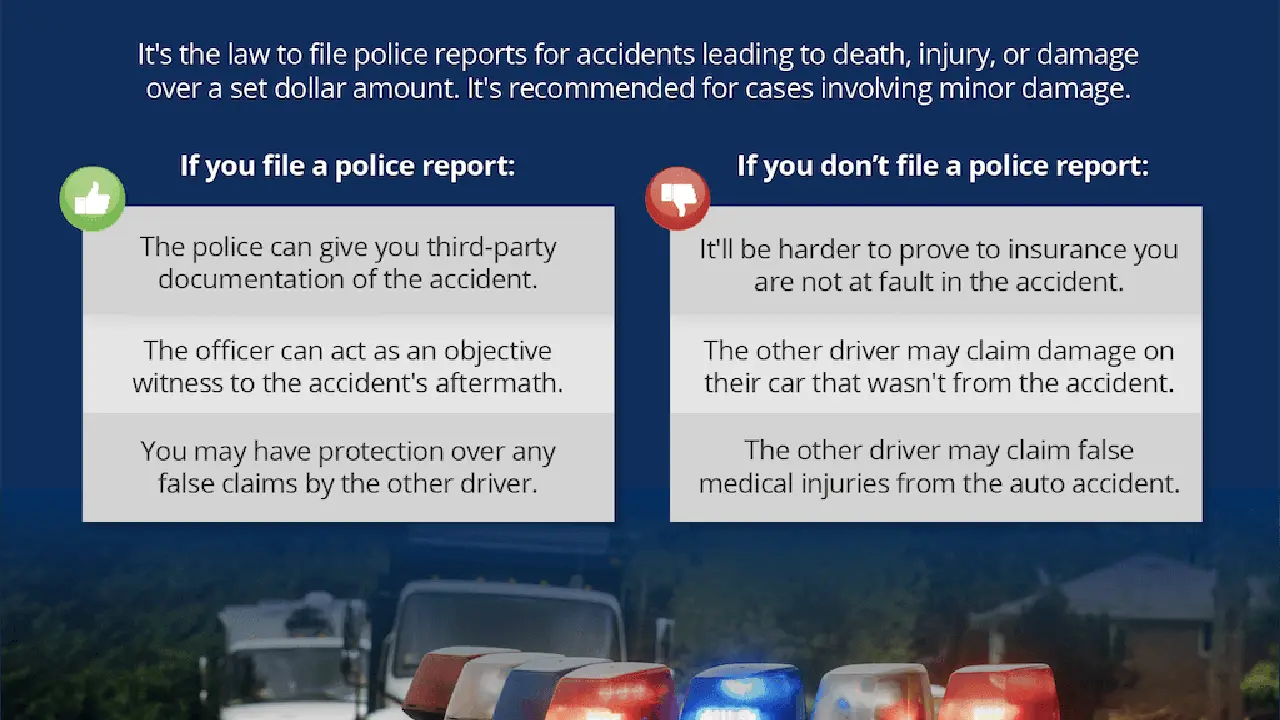

- Police Report Number: If the police were called to the scene, get the report number.

- Photos and Videos: Take pictures of the damage to all vehicles, the accident scene, and any injuries.

Having all this information handy will make the reporting process much smoother and faster. Trust me, you don't want to be scrambling for details while you're on the phone with an insurance adjuster.

How to Report the Accident to Your Insurance Company: A Step-by-Step Guide

Alright, you've got your policy in hand and your information organized. Now it's time to report the accident. Here's how to do it:

- Call Your Insurance Company: Most insurance companies have a 24/7 claims hotline. Find the number on your policy or online.

- Speak to a Claims Adjuster: You'll likely be connected to a claims adjuster who will handle your case. Be polite and professional, even if you're feeling stressed.

- Provide Accurate Information: Answer the adjuster's questions honestly and accurately. Don't exaggerate or leave out any details.

- Explain the Accident Clearly: Describe what happened in a clear and concise manner. Use the information you gathered earlier to provide a detailed account of the accident.

- Answer All Questions: The adjuster will ask you a series of questions about the accident. Answer them to the best of your ability. If you don't know the answer to a question, say so.

- Ask Questions: Don't be afraid to ask the adjuster questions about the claims process, your coverage, and what to expect next.

- Obtain a Claim Number: The adjuster will assign you a claim number. Write it down and keep it in a safe place. You'll need it for all future communication with the insurance company.

- Document Everything: Keep a record of all conversations you have with the insurance company, including the date, time, and the name of the person you spoke with.

Remember, reporting the accident is just the first step in the claims process. Be patient and persistent, and don't be afraid to advocate for yourself.

Documenting the Damage: Using the Right Tools for Accident Photos and Videos

Let's talk about taking photos and videos. You want to capture everything clearly and effectively. Forget about being a professional photographer; just focus on getting the important details.

Smartphone Cameras: Your smartphone is usually the best tool. Most modern phones have excellent cameras. Make sure you have good lighting and take multiple shots from different angles.

Action Cameras (like GoPro): If you have one, an action camera can be great for capturing wide-angle shots of the accident scene. They're also durable and waterproof, which is a bonus if the weather is bad.

Dash Cams: If you have a dash cam, this can be invaluable evidence. Make sure the footage is saved and accessible.

Product Recommendations and Comparisons:

- Anker Roav DashCam Pro: A reliable and affordable dash cam with excellent video quality. It's about $80.

- GoPro HERO12 Black: More expensive (around $400), but incredibly versatile. Great for action shots and high-quality video.

- iPhone 15 Pro: If you want a great smartphone camera, the iPhone 15 Pro is hard to beat. It's pricey (starting at $1000), but the camera is top-notch.

When to use them: Use your smartphone for general photos of the damage. Use a GoPro for wide-angle shots of the accident scene. Use a dash cam to provide a continuous record of the event leading up to the accident.

Understanding Policy Deadlines: When to Report Your Accident

Don't procrastinate! Most insurance policies have deadlines for reporting accidents. These deadlines can vary depending on your policy and state laws. Failing to report an accident within the specified timeframe could jeopardize your claim.

As a general rule, report the accident as soon as possible. The sooner you report it, the fresher the details will be in your mind, and the easier it will be for the insurance company to investigate the claim. Even if you're not sure who's at fault, it's always best to report the accident.

Check your policy documents for specific deadlines. If you're unsure, call your insurance company and ask. It's better to be safe than sorry.

What Happens After You Report: The Insurance Claim Process Explained

Okay, so you've reported the accident. What happens next? Here's a breakdown of the insurance claim process:

- Investigation: The insurance company will investigate the accident to determine who's at fault and the extent of the damages. This may involve reviewing police reports, interviewing witnesses, and inspecting the vehicles involved.

- Damage Assessment: The insurance company will assess the damage to your vehicle and any other property involved in the accident. This may involve getting estimates from repair shops or sending an adjuster to inspect the damage.

- Negotiation: The insurance company will negotiate with you to reach a settlement agreement. This may involve discussing the cost of repairs, medical bills, and lost wages.

- Settlement: Once you reach an agreement, the insurance company will issue a payment to cover the damages.

The entire process can take weeks or even months, depending on the complexity of the accident. Be patient and persistent, and don't be afraid to negotiate with the insurance company to get a fair settlement.

Dealing with the Insurance Adjuster: Tips for Effective Communication

The insurance adjuster is your main point of contact throughout the claims process. Building a good relationship with your adjuster can make the process much smoother. Here are some tips for effective communication:

- Be Polite and Professional: Even if you're frustrated, remain polite and professional in your interactions with the adjuster.

- Be Organized: Keep all your documents organized and readily available.

- Document Everything: Keep a record of all conversations you have with the adjuster, including the date, time, and the topics discussed.

- Be Clear and Concise: Communicate your needs and expectations clearly and concisely.

- Don't Be Afraid to Ask Questions: If you don't understand something, ask the adjuster to explain it to you.

- Don't Be Afraid to Negotiate: If you're not happy with the settlement offer, don't be afraid to negotiate.

Remember, the adjuster is not your enemy. They're just doing their job. By building a good relationship with your adjuster, you can increase your chances of a successful claim.

Potential Pitfalls: Common Mistakes to Avoid When Reporting an Accident

There are a few common mistakes people make when reporting an accident. Avoid these pitfalls to ensure a smooth claims process:

- Delaying Reporting: As mentioned earlier, report the accident as soon as possible.

- Providing Inaccurate Information: Be honest and accurate in your reporting.

- Admitting Fault: Don't admit fault at the scene of the accident. Let the insurance company investigate.

- Signing Anything Without Reading It: Read all documents carefully before signing them.

- Accepting the First Offer: Don't accept the first settlement offer without carefully considering it.

- Failing to Seek Legal Advice: If you're unsure about your rights, seek legal advice from an attorney.

Staying Calm and Collected: Managing Stress After an Accident

Being in an accident is stressful. It's important to take care of yourself during this time. Here are some tips for managing stress:

- Take Deep Breaths: When you feel overwhelmed, take a few deep breaths to calm your nerves.

- Talk to Someone: Talk to a friend, family member, or therapist about your feelings.

- Exercise: Exercise can help reduce stress and improve your mood.

- Get Enough Sleep: Aim for 7-8 hours of sleep per night.

- Eat Healthy: Eat a healthy diet to fuel your body and mind.

- Avoid Alcohol and Drugs: Avoid alcohol and drugs, as they can worsen stress and anxiety.

Remember, it's okay to ask for help. Don't be afraid to reach out to friends, family, or professionals for support.

Final Thoughts: Preparing for the Next Steps

Reporting the accident is just the first step. By following these tips, you can navigate the claims process with confidence and ensure a fair settlement. Remember to stay organized, communicate effectively, and take care of yourself. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

.webp)